Japan – Deflation

While the rest of the world was trying to find the key to unlock the combination of high unemployment and high inflation in the early 1980’s, Japan provided a beacon of economic hope. It was an economic powerhouse with very low unemployment, high savings and modest inflation. Unfortunately, it was sowing the seeds for what would become two decades of stagnation from 1995. By this time, its finance system was carrying high levels of debts on assets that were over- valued. At the same time the underlying structure of the Japanese economy was shifting, in particular the workers that had dedicated their lives to organisations were reaching retirement. The economic cycle was turning and Japan was only prepared for going straight – so they crashed straight into deflation.

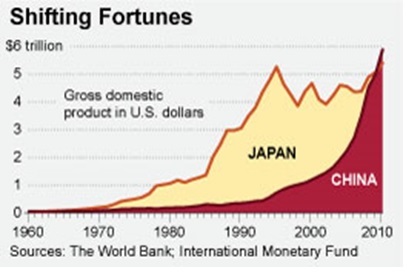

Japan has few natural assets – it is a relatively small island prone to earth quakes with few mineral deposits. What it lacked in resources in made up for in ingenuity. Japan is a human economy, importing raw materials and exporting finished goods it has been remarkably successful for a nation with so few natural assets. Unfortunately, its economic growth has struggled since the mid 1990’s, while China has grown dramatically from a low base – See the graph below.

Adding further pain to this has been a number of unsuccessful attempts and Keynesian based economic stimulus that have substantially increased the Nations debt levels, particularly Government debt – see chart below.

The trigger for Japan’s change in economic circumstances is often regarded as the well documented real estate bubble of the late 1980’s and early 1990’s, (see graph below). In which real estate prices tripled in value from 1985 to 1991. There are many theories regarding why this bubble might have had a prolonged impact on the economy. Much has been made of the number of bad loans that the Japanese banks and institutions have carried since that time, and the burden this has been on the economy. But this fails to recognise the fact that the economy grew by more than 50% in the five years after the real estate crash.

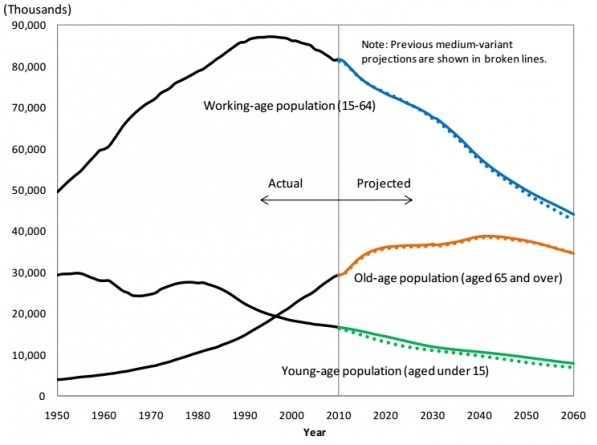

The underlying reason for the change in the Japanese economy is demographics. Put simply the Japanese population is getting older and smaller, (see graph below). This would have a significant negative impact on any economy, but the effect is amplified when the economy is fundamentally a human economy like the Japanese economy. When the ratio of working to non-working people increases, the economy shrinks. When populations decline, demand for housing and services also decline, (as seen by many rural communities around the world in the last 100 years).

The deflation that Japan has been experiencing is closely aligned with the change in its working population – particularly when adjusted for various government attempts at economic stimulus. Japan is not going through the sort of boom bust cycle that Keynesian economics can address, a fact the ill-timed property boom initially disguised. Like many small rural communities before it, Japan will need to reinvent its economy if it is going to avoid ongoing decline.

Recap

- Reward for effort – fewer Japanese are being rewarded for their efforts

- Value is relative – an aging and shrinking population reduces the relative value of things, particularly property and services, which causes deflation.

- Trade requires difference in value – people that are not working have less money and so the volume and value of trade is reduced, which causes deflation.

- Money is a catalyst – once there is enough money in the economy adding more does not increase trade.

- Trade creates economic ecosystems – Japan is still a significant participant in the world economy, and as such is impacted by world events and world trade.

- Economic measurements are incomplete – as population growth has been a prominent feature of the last two centuries, there is insufficient understanding of the economic impact of aging and shrinking populations.

Next – Asian Financial Crisis