Australia is currently the country experiencing the longest run of continuous growth in the world with over two decades of continuous growth. This statistic hides the fact that it has not all been smooth sailing. During this time it has weathered the Asian Financial Crisis, the Dot.Com Crash, the Global Financial Crisis and more recently the slump in commodity prices. While it is a stable democracy, its political leadership has also been many and varied during this time – in the last five years alone it has had four different Prime Ministers, two from each of the major parties. So what is the secret to Australia’s economic durability?

Australia might be best known internationally for its unique and exotic wildlife symbolized by the kangaroo, but that is not what everybody sees. Financial markets use the Australian dollar as an alternate to the US dollar. Potential immigrants see Australia as a great place to live. Resource poor countries see Australia as a reliable supplier of commodities. Australian’s also see the world differently, simultaneously being part of it and removed from it. All of these views have played a role in Australia’s economic success.

The Australian economy is ranked 13th largest in the world and accounts for less than 2% of world GDP. In contrast the Australian currency is the 5th most traded currency in the world, accounting for nearly 9% of all currency trades (four times the volume of trade in the Chinese yuan). The popularity of the Australian currency is certainly not explained by Australia’s international trade which ranked at 24th in the world – even lower that its GDP ranking. Remember how we explained that money is not real – well the Australia dollar’s popularity is because as a currency it is more real than most. Australia has never defaulted on a loan, it has significant trade with most of the major world economies which ensures its value is frequently re calibrated. So when currency traders want to trade against a particular currency, the Australian dollar is a popular alternative. However, its role as an alternative currency also makes it a volatile currency. Fluctuations in the Australian dollar are often due to potential movements in other currencies rather than changes in the Australian economy.

Australia’s economy is also exposed to world trade, with approximately 15% of its GDP being exported, most notably in commodities. Interestingly for the majority of Australia’s long run of continuous growth, its exports have been less than its imports (more detail). So the long run of economic growth has not been export driven.

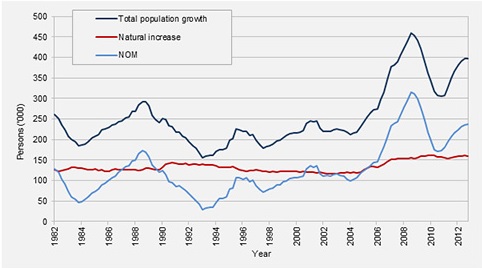

What has underpinned Australia’s economic growth is population growth, which has also played a role in creating the ongoing demand for Australian property. While some of this growth is a result of steady birth rates and increased life expectancy, immigration has played a significant role in Australia’s economic stability and success. This is in no small part because Australia’s immigration policy over the last two decades prioritizes skilled immigrants of working age. While this may not be well understood by the Australian public, sectors of which are vocal in their opposition to immigration, it appears to be understood by the Australian Government.

According the Australian Government Department of Immigration and Border Protection, “Research commissioned by us consistent with the 2010 Intergenerational Report shows that after 2036 there will be more Australians retiring from the labour force than joining the labour force. This is because of the ageing baby boom generation and because long-term fertility rates remain below replacement level. Immigration currently provides 60 per cent of Australia’s population growth, but within the next few years it will be the only source of net labour force growth in Australia. Without immigration, labour force growth will almost cease within the next decade.”

The economic impact of this immigrant workforce should not be underestimated. It has effectively given Australia an extra 40 years before it follows Japan into a demographic lead economic decline due to the increased burden placed on the working population by those that are too young or too old to work. By then Europe, China and possible the USA will have followed Japan through this demographic change and potentially found a solution to the demographic lead economic decline that Japan has so far been unable to resolve.

While generally regarded as being a commodity economy, Australia is actually a people economy, by growing its population and its working age population simultaneously it has also managed to grow its GDP per head. The growing population is what continues to drive the Australian housing market. Not all Australian houses are increasing in value, but those that are located where the population is growing fastest have increased in value the most. It is a simple case of supply and demand.

By managing to maintain its reputation as a great place to live – Australia continues to attract multi-national businesses, foreign students and global professionals. At a micro economic level these are factors which continue to provide strong sources of foreign investment as individuals bring their savings with them and invest in their new lives in Australia. It is the sort of investment that is unlikely to be reversed while Australia maintains its reputation as a multicultural global society, physically isolated from the terrors and traumas of the world. Or as the BBC described it, “the lifestyle superpower”.

Recap

- Reward for effort – More Australians are being rewarded for their efforts

- Value is relative – a growing population and workforce increases the relative value of things, particularly property and services, which prevents deflation.

- Trade requires difference in value – people that are working have more money and so the volume and value of trade is increased.

- Money is a catalyst – the Australia dollar is a catalyst for foreign currency trades, increasing its liquidity.

- Trade creates economic ecosystems – Australia is a significant participant in the world economy, and as such is impacted by world events and world trade.

- Economic measurements are incomplete – Australia’s negative balance of trade does not reflect the long term positive impact of the net inflow of skilled immigrants.