Trump and Economics

In the lead-up to the 2016 American Presidential election, The Economist magazine published a series of editorials condemning Donald Trump’s economic credentials and policies. The respected publication was not alone in predicting dark days ahead if Trump was to be the next US President. Then he won, and the US dollar, US stock market and US interest rates have all climbed higher before he even spent his first day in the job. Why, and what does Trump mean for the US economy?

The story so far

First, we should look at the changes in some of the economic indicators. The link between politics and economics has historically been overstated in good times, and understated in bad. Given that the man is not yet in office, it is more than likely that his link to the current upswing in the US dollar, US stock market and US interest rates, is overstated.

The value of the US dollar has increased against all other currencies, but this is not necessarily because of Trump. The US dollar is still returning from its historically low values post the GFC in 2008, (see graph below). These low values were initially due to the economic shock of the GFC, and then extended due to the prolonged and unprecedented levels of quantitative easing undertaken by the US Treasury.

The substantial increase in the value of the $US coincides with a change in policy from the US Treasury in late 2014 and beyond. Factor in the usual drop in value in the lead up to an election and the increase in value in the US currency since Trump’s victory can be seen as a continuation of this trend.

A long-term view of the Dow Jones also illustrates that the current increase in stock value is more of a return to the long-term trend that an exception to it (see left hand graph below), although the right-hand graph below illustrates how tumultuous the market has been through 2016. Some fluctuation is expected in the lead up to an election as the market tries to pick potential winners and losers. Once the election result is known a return to the long term trend should be expected.

Source: http://stockcharts.com/freecharts/historical/marketindexes.html

The change in interest rate has also captured the public’s attention. However, it too needs to be seen in an historical context, the Prime Rate was at historical lows, and the 30-Year US Treasury Yield was also at historically low levels (see left-side of chart below). The significant movement evident in 2016, (see right hand graph), are actually a relatively normal part of the bond yield landscape.

What does this tell us about Trump and economics? Not much just yet. It says that Trump will enter office with some key economic indicators pointing in the right direction, and with his party holding a majority in both houses. Given most new Presidents also get a honeymoon period, President-Elect Trump could not have wished for better circumstances in which to enter office, (apart from the record budget deficit). But what will the economy be like under Trump?

Trump’s Economic Agenda

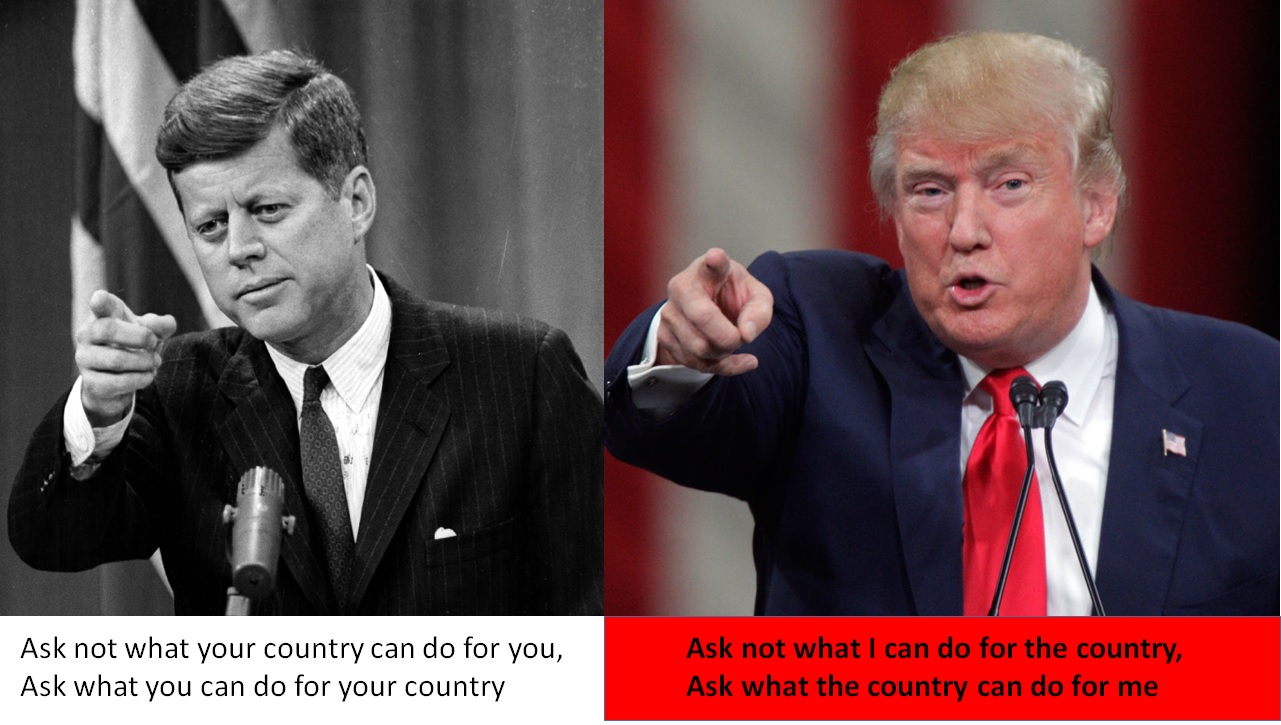

Trump won the election by appealing to self-interest. Where JFK had said “Ask not what your country can do for you, ask what you can do for your country”, Trump has done the opposite. He has appealed to the elite by promising tax cuts, he has appealed to the poor by promising increased government spending, to fight imports and to deport illegal immigrants. He was appealed to military families by promising to withdraw from the world, and to the military industrial complex by promising to spend more. He has appealed to the disenchanted by becoming the face of the anti-establishment. Trump has unashamedly put ‘me’ before ‘we’.

Given that it is not possible to keep so many conflicting promises, the key question is, what will Trump do? His refusal to follow protocol during the election process, and his appointments since taking office, point to an animosity towards current government establishments. His admiration of Putin perhaps shows the sort of government he would like to replace it with. Putin has blended his commercial interests and political interests such that the Russian government are often seen to be an arm of his commercial enterprise. Trump is likely to prioritise his commercial interests during his time in office. Since his election win, Trump is preparing for office more like he has made a successful business takeover than a person about to have the responsibility for making the right decisions on behalf of all Americans, and as a world leader.

Trump has recruited an executive team that in corporate speak is more likely to ‘asset strip’ than ‘invest in value building’. Don’t be surprised if the first priority of Trump and the Republican party is to reduce the corporate and high income tax rates. The immediate flow on effect of this is to increase corporate dividends, which some investors have already factored into a revaluation of stock prices post the election. This will cost the US government dearly at a time when it is already deeply indebted and is building further debt every year by operating an unbalanced budget. This could provide the excuse needed for wholesale asset stripping of the government. That is, the closure and/or private sale of government operations and facilities. It was also part of the Putin playbook. Selling national assets and monopoly markets to friends and colleagues (also known as cronies) to create oligopolies.

Domestically the short-term impact of these changes will appear to be positive in economic terms. In part because the reduced taxes are likely to fuel increased spending and higher corporate returns until a new equilibrium is reached. Secondly the sale of government operations and facilities will technically increase the size of the economy as the value of these assets is realised. This is like taking gold out of the safe and selling it to realise its value – although no actual new value has been created.

Internationally Trump is also likely to ignore convention and use his position to positively impact on his commercial interests. This will see considerable public blustering on his part, while his cronies are negotiating private deals. It is very easy for the man with the world’s largest military power at his command to make people ‘offers they can’t refuse’. If during the term of his office you cannot understand US foreign policy, just understand you are not meant to. A reputation for being inconsistent and irrational can be very useful when you need to change your public stance on something without apparent reason.

Long Term Impact

The long-term impact of Trump could be disastrous, even if he refrains from making significant changes to the US foreign policy and international relationships. A key legacy of the Trump Administration is likely to be a widening of the gap between rich and poor, and to financially cripple the US government.

Having been elected by the American heartland with a promise of ‘making America great again’ and restoring their standard of living, he is likely to leave office as a false prophet for positive change, one that has reduced the economic and political power of America and pushed the majority of American’s into a cycle of debt- laden poverty. Just as the Arab Spring has morphed into a Syrian Hell, Trumps ‘me first’ campaign may be the first step toward the next American revolution. One fuelled by the accelerating gap between rich and poor, and armed by the second amendment.

Hopefully it will not come to that, if the elite, particularly senators and congressmen, decide to ask ‘not what their country can do for them, but what they can do for their country’. It is time to stop having short term gain for long term pain.

Recap

- Reward for effort – Trump wants to reward the elite with tax cuts, for no change in effort

- Value is relative – Trump is promising to distinguish between the value of american goods compared to international goods by raising tariffs.

- Trade requires difference in value – by imposing tariffs Trump is hoping to improve the comparative value of US goods by making imported goods more expensive.

- Money is a catalyst – the US dollar is the catalyst for 80% of world trade.

- Trade creates economic ecosystems – The USA will remain a significant participant in the world economy, and as such will continue to be impacted by world events and world trade.

- Economic measurements are incomplete – Any sell-off of government assets is not appropriately reflected in economic measurements – giving a false positive increase to GDP.